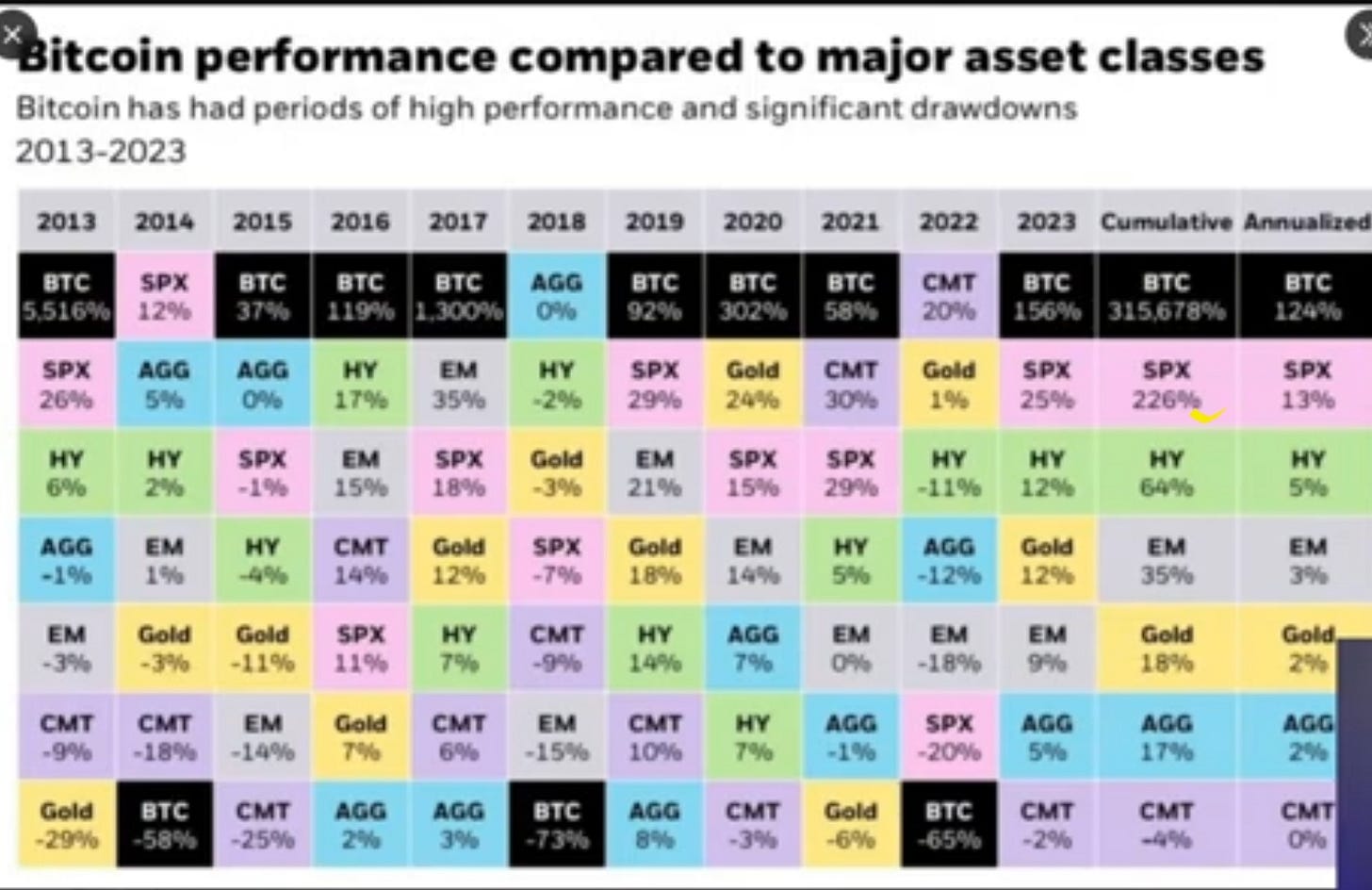

UPDATE: Blackrock is now running ads for their new Bitcoin fund including this chart, for the first time ever, as new investors pour money into the space. Boomers, Gen X’ers and even the RobinHood Gen Alpha crowd have NEVER seen ads like these, as they haven’t been SEC compliant until a week ago. If you think this isn’t going to cause MASSIVE demand for bitcoin (and higher prices) over the coming months, I do believe you’re dreaming. Consider buying the dips (perhaps now) and enjoying the ride with 5 to 10% of your investment assets for starters. (**As always, nothing here is investment advice. You must do your own due diligence or consult your financial advisor who is probably just getting up to speed in this space now that he or she is allowed to include crypto in portfolio allocations, likely for the first time:)

(Original post follows:)

You’d have to be living under a rock not to know this by now.

Yesterday, after stalling for FOURTEEN long years, regulators finally approved a slew of regular exchange traded funds that allow regular investors who never had the time or expertise to “learn bitcoin” to buy the asset directly, in a fully custodianed way, with a simple mouse click in their investing account.

The 11 funds start trading today.

So where are we headed?

With bitcoin still under 50,000, many institutional investors see the potential for this massive new retail demand to drive bitcoin prices up by a factor of 10 or 20 TIMES.

Just one example:

Cathie Wood continues to see $1.5M Bitcoin price as Bitcoin ETF launches

Cathie Wood reiterated Thursday her belief that Bitcoin (BTC-USD) could rally substantially from now until the end of the decade, standing by her previous prediction that the cryptocurrency could touch $1.5M by 2030.

This came as her firm, ARK Invest, in partnership with 21Shares, was part of the first wave of spot Bitcoin exchange traded funds that are now available to investors. In the wake of the ETF news, BTC-USD was up about 9% early Thursday, climbing to about $48.9K.

"Our base case is in the $600K range,” Wood stated in a CNBC interview. “Our bull case is $1.5M by 2030.”

For Wood's call to be correct, Bitcoin would need to advance roughly 1,161% over the next handful of years to hit $600K. Meanwhile, the cryptocurrency would need to propel upwards by approximately 3,112% to hit $1.5M.

For reference, over the previous 5 years, the digital currency has advanced by 1,202%, although it is currently well off of its all-time high of more than $68K, which it reached in 2021.

In her CNBC interview, Wood also talked about the competitive landscape for the new spot Bitcoin ETFs, which she says will now engage in a fierce competition to gain market share. "Typically, just a few" will end up on top, Wood stated, although she expressed confidence that Ark 21Shares Bitcoin Trust (BATS:ARKB) will be one of those names.

Listed below are the Bitcoin (BTC-USD) exchange traded funds that were approved by the U.S. Securities and Exchange Commission:

Grayscale Bitcoin Trust (OTC:GBTC)

iShares Bitcoin Trust (IBIT)

Valkyrie Bitcoin Fund (BRRR)

Ark 21Shares Bitcoin Trust (ARKB)

Invesco Galaxy Bitcoin ETF (BTCO)

VanEck Bitcoin Trust (HODL)

WisdomTree Bitcoin Trust (BTCW)

Fidelity Wise Origin Bitcoin Trust (FBTC)

Bitwise Bitcoin ETF (BITB)

Franklin Bitcoin ETF (EZBC)

Here’s a fascinating new overview/interview with Kathy Wood

Study up! Most of you don’t know what you don’t know right now.

Opportunity Knocks!

(*nothing here is investment advice. As always, you must do your own due dilligence)

HEADS UP! Fidelity's bitcoin fund ticker “FBTC” (a Jimychanga fav!) ETF has consistently attracted at least $100 million of net inflows every trading day, taking the firm’s total to $1.9 billion.

I TRUST YOU ARE GETTING 5.3% on your SAFE "BANK" MONEY right now, especially if investing is not your cup 'o tea!

Changa showed you how to do it easily, and with full liquidity FDIC guarantees, right from you desktop in 5 minutes.

Here's the post from November:

https://jimychanga.substack.com/p/gift-for-paid-subscribers