Update: THE HALVENING

It's 100% Guaranteed to Happen

The Halving

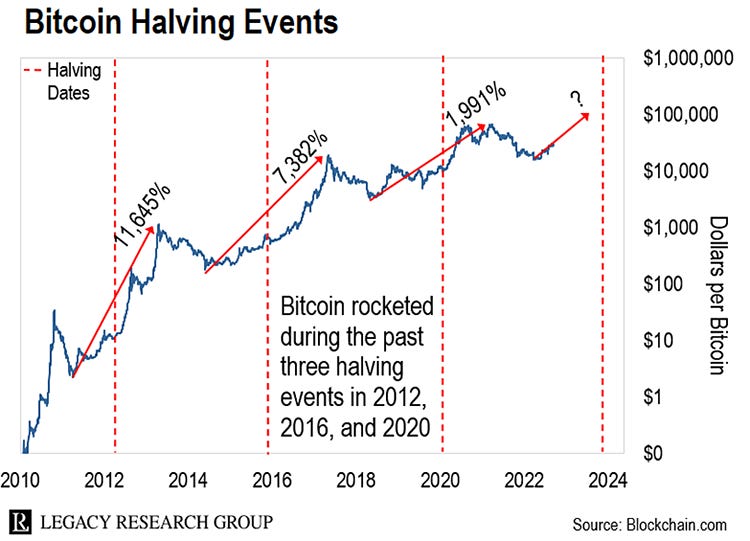

The coming catalyst for bitcoin, (and usually most other crypto and alt coins) is the next halving.

For those who need a refresher, the anonymous programmers behind bitcoin hardwired the *halving into bitcoin’s code. It cuts the reward for mining bitcoin transactions on the network in half.

So, like clockwork, halvings are 100% guaranteed to happen.

The first halving was in 2012… the second was in 2016… and the most recent was in 2020.

After every halving, we’ve seen bitcoin rise further…

After the first halving in November 2012, the block reward dropped from 50 bitcoins to 25. And the price went from about $12 to a peak of $1,100 by 2013.

The second halving occurred in July 2016. The block reward went from 25 to 12.5. That sent prices from $650 to a peak of nearly $20,000.

The third halving hit in May 2020. Prices went from $8,500 to over $65,000 at their peak.

While the halving is a bullish catalyst for bitcoin, the second year after a bitcoin halving is always a down year.

In 2012, bitcoin had its first halving. Prices soared in 2012 and 2013. But in 2014, bitcoin fell 61% for the year.

In 2016, bitcoin had its second halving. Prices rose in 2016 and 2017… and then dropped 73% in 2018.

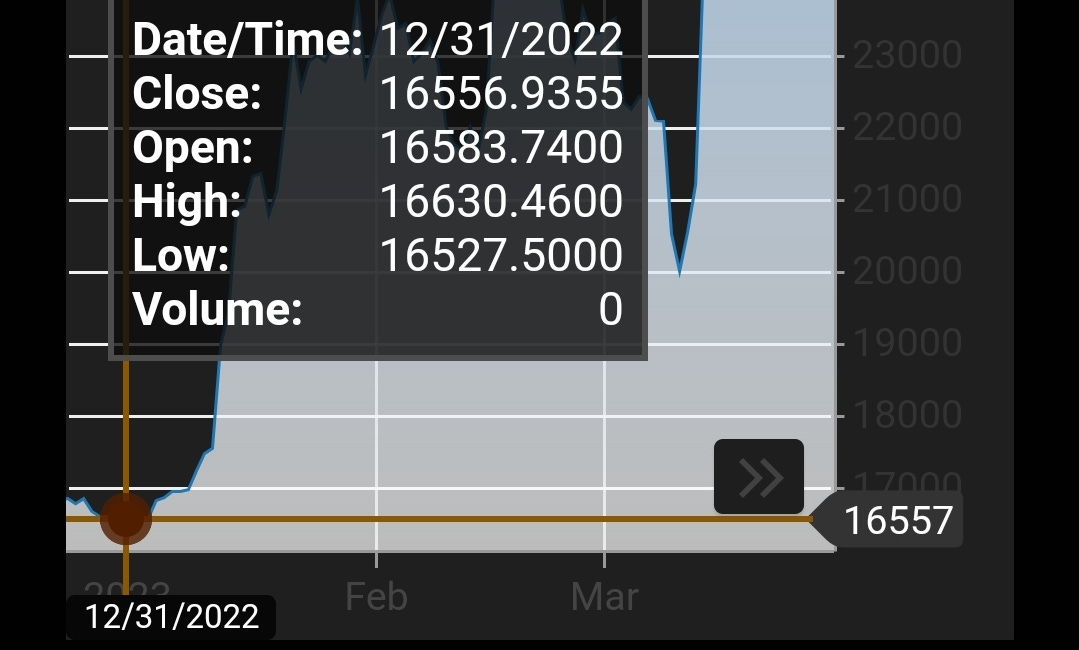

In 2020, bitcoin had its third halving. Prices soared in 2020 and 2021… But in 2022, bitcoin lost 64%.

Each and every time, bitcoin bounced back…

As you can see above, the halving is a huge catalyst for bitcoin. If history is any indicator, the 2024 halving will push bitcoin to new highs and beyond

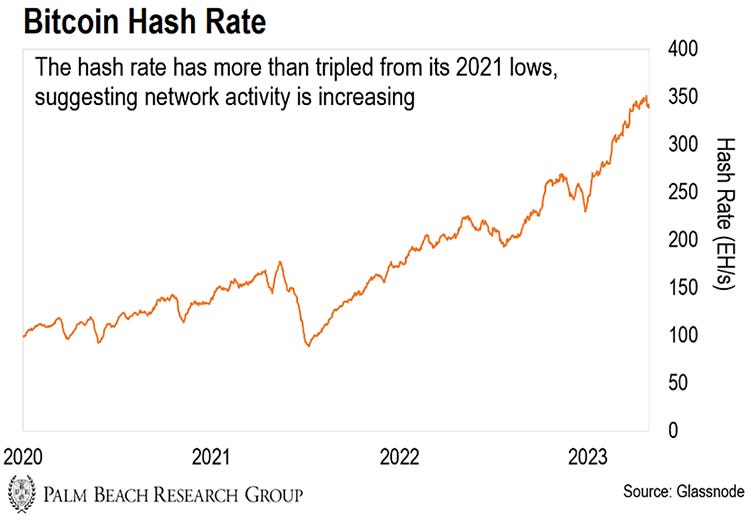

The Bitcoin Hash Rate Is Growing

One measure of the strength of the bitcoin network is the hash rate. That shows the rising computational power needed to power the network.

Essentially, the hash rate shows the “network effect” of more individuals and institutions moving into bitcoin and other crypto assets.

Even amid the price collapse of BTC during the 2022 Crypto Winter, the network’s hash rate more than tripled from the 2021 lows to over 350 exahashes per second (EH/s).

This explosive growth of usage on the bitcoin network is a strong signal that we’re getting over the worst of last year’s sell-off.

According to Metcalfe’s Law, the bigger the network of users, the greater the value of the network.

Think about Amazon, for example. The network effect triggered enormous growth for the tech giant.

As more people signed up for Amazon’s Prime membership, its share price climbed from around $300 in 2014 to an all-time high of over $3,700 in 2021.

That’s a 12x gain in just a few years.

Bitcoin’s adoption is on the same trajectory as other groundbreaking technologies.

According to former Google engineer Michael Levin, bitcoin’s current adoption rate puts it on track for 1 billion bitcoin users by 2025… about half the time it took the internet to reach the same milestone.

That’s why over the coming years, some experts expect a single BTC will be worth $500,000.

None of this is investment advice. I am not a trail guide. I use a Roth with Alto IRA for tax free crypto investing, and hold massively discounted closed end funds ETHE AND GBTC as well as crypto company related etf DAPP in taxable accounts as of now.

But that's just me.

I could be wrong. Do your own Due Dilly, as always.

*both “halving” and (way more art noir) “halvening” are used to describe this phenomenon

Previous posts On topic, FYI:

You're Up 80%, If You Read this Stack

So Bitcoins up 80% since I told you right here that I was buying it, and Ethereum not far behind. Nothing here is investment advice, but I hope for your sake that you read the charts and arguments with me back when you were making New Year’s Resolutions!

UPDATE!!!

BlackRock files for spot bitcoin ETF, with Coinbase as a crypto custodian

You knew they’d end up controlling and benefiting from all crypto. (After all, “Shatoshi Nakamoto” translates loosely to “CIA Black Budget Projekt” by some accounts) Have you ever seen him/her/insert pronoun? I rest my case.

How? It’s just so much easier for the average person to buy bitcoin etc via an exchange traded fund. Grayscale and many others have tried to get an ETF approved for YEARS but have been nitpicked to death and forced into using closed end funds and other vehicles.

NOW BIG DOG WEF’fer-loving giant lapdog Blackrock (where Ed Dowd came from) is applying. What are the odds they already got the nod before starting? They will corral most folks into their convenient vehicle, I’m guessing, where you are automatically fully taxed and “on grid”, and can easily be forced to accept face value in US dollar if TPTB ever decide to get rid of crypto altogether. Neat, huh?

For now, this may be the soft sell (the fun route to tyranny, like everything else these days), where you can potentially make a Sheisseload, and they can still control the outcome without having to resort to an EMP to pull down the crpto grid. Behemoth Blackrock Makes its Move

Enjoy, and remember to Make Hay While the Sun Shines!

Food for Thought:

( NOT advice)

Gensler’s Anti-Crypto Crusade Is a Smoke Screen… Is This the Real Hidden Agenda?

By Chaka Ferguson, editorial director, Palm Beach Daily

The old saying goes: Keep your friends close… and your enemies closer.

We didn’t think it also meant arranging a marriage between the two.

BlackRock is the world’s largest asset manager, overseeing $10 trillion in client funds.

On Thursday, we got word the Wall Street titan plans to file an application to register a bitcoin exchange-traded fund (ETF) with the Securities and Exchange Commission (SEC).

Talk about irony…

This is the same SEC that charged Coinbase and the U.S. subsidiary of Binance with operating as unregistered securities exchanges.

But wait! There’s more…

BlackRock has partnered with none other than Coinbase to bring the ETF to its customers.

Yes.

The same Coinbase that SEC boss Gary Gensler and his G-men are suing.

As Teeka wrote earlier this week, the SEC crackdown is all a smoke screen:

It’s more about clearing the deck for the big boys of U.S. finance – like JPMorgan Chase and BlackRock – to muscle into the crypto space.

This is the clearest sign yet of that hidden agenda.

Why would the world’s largest asset manager partner with a company facing charges from the SEC… to offer a crypto product that the SEC is skeptical of?

Here’s Teeka again:

The people who run the banks and brokerage houses aren’t dumb. Regardless of what the feds say, they know crypto is the future.

Today, bitcoin’s market cap stands at around $504 billion. That’s a spit in the ocean compared to the total estimated global wealth of $463 TRILLION.

If just 5% of that flows into bitcoin, it’ll go up 47 times higher.

That’s why Fidelity and BlackRock are creating crypto custody solutions for their clients. They want a slice of the pie.

Staying informed about what’s happening beneath the surface in crypto can help you stay the course when the mainstream media – and even your friends and family – are calling crypto a “scam.

Do you have any idea how much you'd be up with the holding we highlighted over a year ago???

Not to toot, but just to show Changa knows a few things...

(Not financial advice**)

Top 5 Crypto-Focused ETFs (SA Quant)

Jun. 11, 2024 7:00 AM ET

BITW, GBTC, GDLC (sound familiar??)

Steven Cress, Quant Team

SA Quant Strategist

Summary

Bitcoin is up ~170%, Ether ~+100%, and Solana over 930% over the last year, and the number of worldwide crypto users is projected to reach 992.50M by 2028.

Cryptocurrency ETFs offer exposure by investing directly in the assets and/or companies involved in the digital economy.

5 crypto-focused ETFs, +240% on average in 1Y, offer exposure to several digital assets and firms involved in the digital economy for investors with an appetite for risk.

ismagilov

Crypto Investing

Cryptocurrencies have exploded in the past year, with Bitcoin (BTC-USD) up ~170%, Ethereum (ETH-USD) ~+100%, and Solana (SOL-USD) more than 930%. Digital assets are progressing on the regulatory fronts and have even become hotter topics, particularly in the wake of Robinhood’s $200M acquisition of Bitstamp. Bitstamp is a small crypto exchange competitor behind Binance and Coinbase Global (COIN).

992.50M by 2028, driven by increasing institutional acceptance and higher usage in cross-border transactions.

The price of Bitcoin crossed the $1.00 threshold for the first time ever in February of 2011, and nearly ten years ago was worth $580. Bitcoin is now trading at more than $71,800 with a market cap of $1.4T. Bitcoin has about 53% of the crypto market followed by Ether (17%), Tether (USDT-USD) (4.2%), Binance Coin (BNB) (4%), and Solana (3%). Bitcoin and Ether dominate in size, but Solana is the highest-performing cryptocurrency among the digital asset giants in the past year.

Solana Leads Top 5 Cryptocurrencies in 1Y Price Performance (as of 6/10/24)

Top Cryptocurrencies 1Y Performance (SA Premium)

Seeking Alpha’s Quant ETF Grades are generated by a proprietary system that aims to provide investors an instant characterization of each ETF. The SA quant system grades ETFs by five factors:

Cryptocurrency-focused ETFs invest directly in the digital assets or indirectly in miners and stocks involved in crypto. Although crypto ETFs have strong momentum, investors should realize they are also highly volatile. The SA Quant Team identified five ETFs that provide investors exposure to a variety of crypto assets. The ETFs have ‘Strong Buy’ ratings and excellent momentum, evidenced by a market-crushing average 1Y price performance of ~+240%. The list includes 2 ETFs ranked outside of the top five to prevent overlaps and ensure breadth of coverage of major digital assets.

1 Grade. (OTCQX: GDLC)

Assets (AUM): $582.92M

Quant Rating: Strong Buy

Quant Ranking in Asset Class (as of 6/10/24): 6 out of 197

Quant Ranking in Asset Sub Class (as of 6/10/24): 6 out of 21

Only three among 2,462 quant-rated ETFs have a higher 1Y price performance than GDLC, which is up a whopping 322% in the past 12 months, driving an ‘A+’ in Momentum.

GDLC 1Y Price Performance (as of 6/10/24)

GDLC 1Y Price Performance (SA Premium)

GDLC holdings include BTC (70%), ETH (23%), SOL (4%), Ripple (XRP-USD) (1%), and Avax (AVAX-USD) (0.70%). GDLC has a ‘B’ in Liquidity, driven by an average daily dollar volume of $2.37M. GDLC has an expense ratio of 2.50% and annualized volatility of 71%.

GDLC Holdings

GDLC Holdings (Grayscale)

3. Grayscale Bitcoin Trust ETF (NYSEARCA:GBTC)

Assets (AUM): $19.76B

Quant Rating: Strong Buy

Quant Ranking in Asset Class (as of 6/10/24): 3 out of 197

Quant Ranking in Asset Sub Class (as of 6/10/24): 3 out of 21

GBTC is the third hottest ETF in price performance over the past year, up more than 340%, solely and passively invested in Bitcoin with an A+ in Momentum. GBTC has returned more than 490% to shareholders in the past five years vs. an ETF median of 38%, and significantly outperformed in returns over the last 6M and 30 days. GBTC’s A+ in Liquidity is driven by an AUM of $19.76B and a daily dollar volume of $620.65M.

UPDATE

ONLY 35 MORE DAYS TO GO

TILL THE HALVENING!!!

https://www.youtube.com/live/god2-aQvB2A?si=-2XPoaCxoj0cjVyV