The Baumol Effect

The goods and services that have skyrocketed—healthcare, education, childcare—share a hidden trait

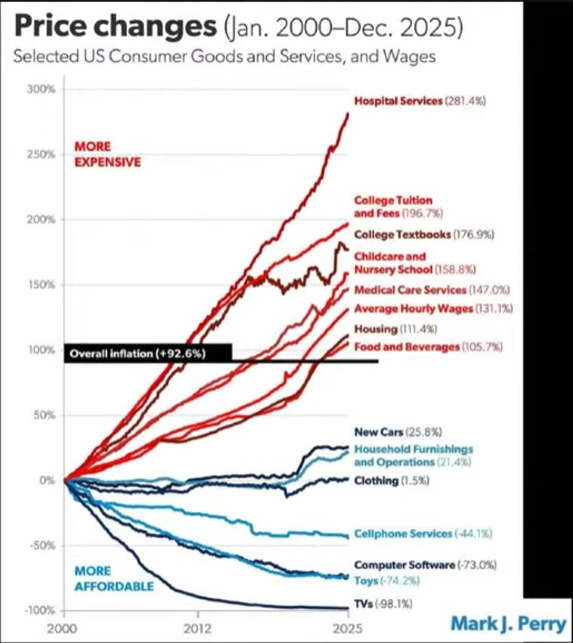

Here’s what’s happened since 2020. If we look beyond the ivory tower hubris of the global plandemic, economic shutdown, and unprecedented money printing that followed in a scramble to retain power in a world they nearly broke, some interesting details emerge:

The goods and services that have skyrocketed—healthcare, education, childcare—share a hidden trait: they’re labor-intensive, regulation-heavy, and resistant to productivity gains. This isn’t just dollar devaluation—it’s a structural mismatch between sectors where tech and AI drive deflation, and sectors where human labor remains irreplaceable.

🧠 What These Sectors Have in Common

These sectors are immune to Moore’s Law. You can’t double the productivity of a nurse, teacher, or daycare worker every 18 months. They’re also heavily regulated, which limits competition and innovation.

💵 Is This a Dollar Devaluation Story?

Partially. The dollar has lost purchasing power, but that alone doesn’t explain the divergence:

Overall inflation: +92.6%

TVs, software, cell service: down 40–98%

Labor-intensive services: up 150–280%

This is relative inflation, not just currency debasement. The dollar buys more tech and less human time.

🤖 AI vs Human Labor: The Real Divide

Tech sectors (deflationary):

Software, electronics, cloud services → scalable, automatable, global competition.

AI drives marginal cost toward zero.

Human-centric sectors (inflationary):

Healthcare, education, childcare → require empathy, supervision, physical presence.

AI can assist, but not replace core labor.

This is the Baumol Effect: wages rise in low-productivity sectors because they must compete for labor with high-productivity ones. If coders get paid more, nurses must too—even if their productivity hasn’t changed.

🧭 Strategic Implications

Investors:

Tech deflation favors hardware, energy, and compute infrastructure (your Elon theme).

Inflationary sectors may benefit from AI augmentation (telehealth, edtech, childcare platforms).

Households:

Budget pressure will keep rising in human-care domains.

AI tools can help mitigate, but won’t eliminate the cost curve.

Policy & Society:

These sectors are ripe for reform—but politically sensitive.

Expect continued divergence unless tech meaningfully disrupts service delivery.

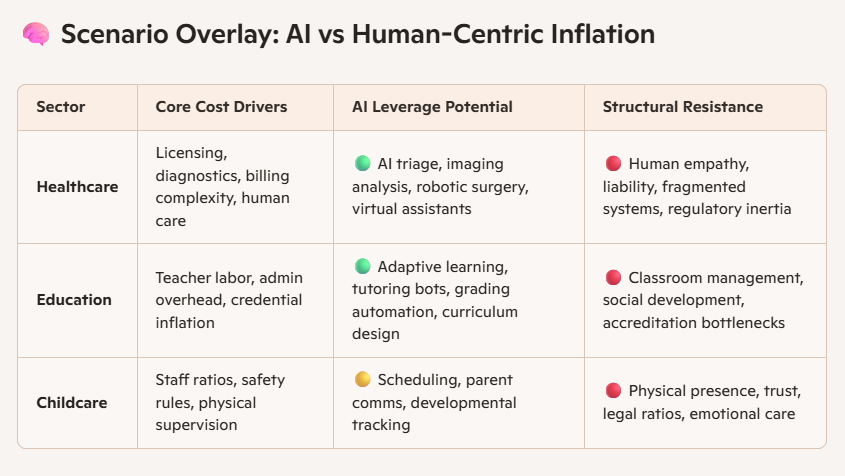

Here’s a scenario overlay mapping how AI could bend the cost curve in healthcare, education, and childcare — the three sectors that have most resisted deflation despite tech advances. These are the inflationary outliers in your chart, and they share deep structural traits: labor intensity, regulatory friction, and low productivity leverage.

🧠 Scenario Overlay: AI vs Human-Centric Inflation

🔍 Key Insights

AI can bend—but not break—the cost curve.

It excels at information tasks (diagnostics, grading, scheduling).

It struggles with presence tasks (comforting a child, managing a classroom, bedside care).

Regulation is the moat.

These sectors are protected by licensing, liability, and compliance.

That slows adoption even when tech is ready.

Trust is the bottleneck.

Parents won’t trust AI with toddlers.

Patients won’t trust bots with surgery—until proven over time.

🧭 Strategic Implications for Builders and Investors

Healthcare:

Invest in AI overlays that reduce admin friction (billing, triage, imaging).

Avoid direct patient replacement — focus on augmentation.

Education:

Build adaptive platforms that scale teacher impact.

Target credentialing reform and micro-certification.

Childcare:

Focus on parent-facing tools: scheduling, updates, developmental tracking.

Don’t try to replace physical care — support it.

🧠 Behavioral Finance Angle

These sectors are sticky because they involve trust, identity, and care.

AI can reduce friction, but emotional labor is still priced at a premium.

The inflation gap is a signal: tech deflation is real, but human care is still scarce.

Implications for College Kids:

This is the heart of the divergence we spotted in that inflation chart: college costs have skyrocketed, but wages haven’t kept pace. That creates a structural challenge for today’s students — they’re paying more for credentials while entering a labor market reshaped by AI and automation. Let’s break it down:

🎓 Implications for What They Study

Fields with AI leverage: Computer science, data science, engineering, finance, and healthcare tech are positioned for wage growth because AI augments rather than replaces them.

Fields vulnerable to automation: Routine business roles, basic accounting, paralegal work, and some media/communications jobs risk wage stagnation as AI substitutes.

Human‑centric fields: Nursing, teaching, social work, childcare — wages rise slower than tuition, but demand remains strong because they’re resistant to full automation.

👉 The mismatch: Students in high‑cost majors (education, healthcare) often face slower wage growth, while lower‑cost majors in tech can capture outsized returns.

🛠️ Supplementary Skills That Matter

AI literacy: Not just coding (which is rapidly being taken over by AI) — understanding how to use AI tools in any field.

Financial discipline: Budgeting, investing, and side‑income skills to offset debt burdens.

Portfolio building: Demonstrating projects, certifications, and applied work beyond the degree.

Soft skills: Communication, collaboration, adaptability — these remain scarce and valuable even in AI‑heavy industries.

Cross‑disciplinary overlays: Pairing a traditional major with a tech or business skill (e.g., biology + data analytics, art + digital design).

💵 Wage‑Earning Outlook

Polarization:

Top quartile (AI‑augmented, specialized skills) → strong wage growth.

Middle quartile (routine knowledge work) → stagnant or declining wages.

Bottom quartile (manual/service work) → modest wage growth, but inflation eats gains.

Credential inflation: Degrees alone don’t guarantee wage premium anymore. Supplementary skills and demonstrable projects matter more.

Debt vs ROI: Rising tuition means students must think like investors — what’s the expected return on their chosen field?

🧭 Strategic Takeaways for College Kids

Pick majors with leverage: Tech, engineering, finance, healthcare tech.

Add supplementary skills: AI literacy, financial acumen, project portfolios.

Think modular: Stack certificates, internships, and side projects alongside the degree.

Plan for resilience: Wages may lag inflation in human‑care fields, so build side‑income streams or specialized niches.

If you’re concerned about preparing your kids for the AI‑era job market. The roadmap is clear: don’t rely on the degree alone. Pair it with certifiable, income‑producing skills and a portfolio that proves adaptability. Saving more than you spend and investing the difference isn’t just a nice idea anymore. It’s now a bedrock-behavior, fundamental and increasingly a pre-requisite for growing the purchasing power of your money faster than the ravages of inflation can erode it.

This framing of the Baumol Effect as an AI divide is sharp. The augmentation angle feels like the realistic path forward rather than full automation dreams. My wife works in early education and they've been experimenting with AI scheduling tools that free up maybe 20% of admin time, but it doesnt change the 1:4 staffing ratios. Those regulatory moats aren't going anywhere soon, so the cost divergence probably continues until something fundamnetal shifts in how we value human-time work.

These inflation numbers are silly since inflation can only be measured on an individual basis and never as a one-size-fits-all one dimensional calculation. The top five listed as experiencing the greatest inflation generally do not apply to me.

However, my inflation rate may be even higher because of a lower base of operations which means that certain price increases may affect me differently since my average income is far below "average".

And what is so over-priced beyond the value you are getting; healthcare, education, childcare.