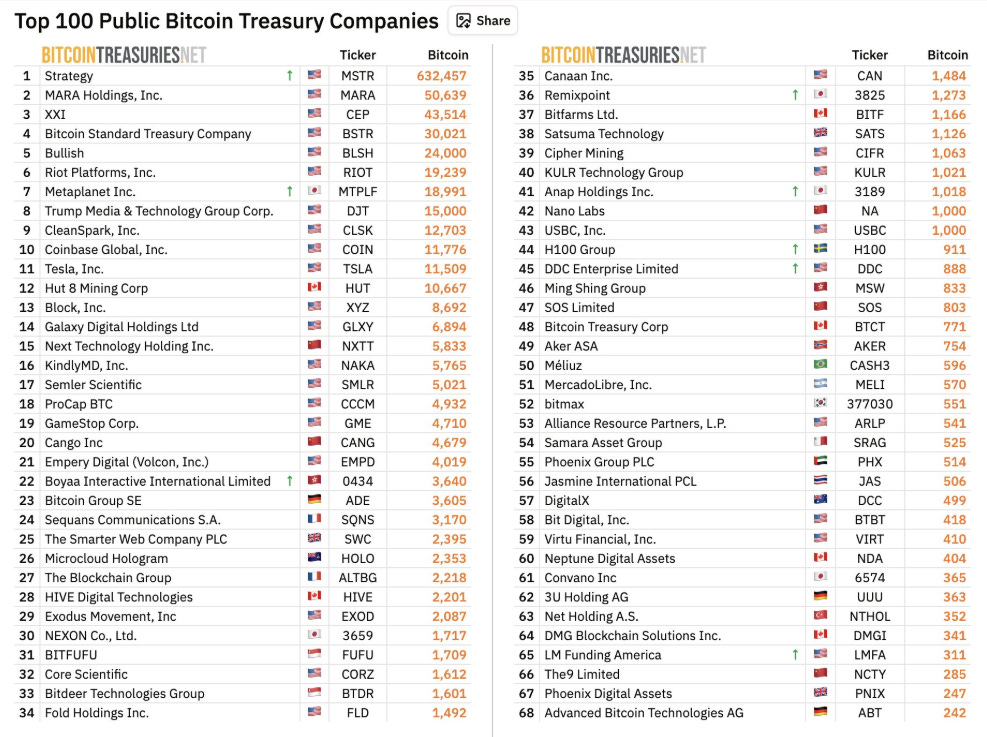

Looks Who's Stacking Bitcoin at the Corporate Level

This is a 180 degree Pivot from just 18 months ago! What do you think "changed"?

Bitcoin treasury companies are publicly traded or private firms that allocate a portion of their corporate treasury reserves—typically cash or cash equivalents—into Bitcoin as a strategic asset. Instead of holding dollars, yen, or euros, they “stack sats” (accumulate Bitcoin) to hedge against inflation, currency devaluation, and macroeconomic instability.

You’ve likely heard about Microstrategy, but the new stackers will blow your mind.

*nothing here is financial advice. Do your own due dilligence*

🏢 What Makes a Company a Bitcoin Treasury Firm?

These companies:

Hold Bitcoin on their balance sheets as a long-term reserve asset

Often disclose BTC holdings in financial reports or investor updates

May raise capital (via equity, debt, or convertible instruments) specifically to buy more Bitcoin

Sometimes operate like quasi-Bitcoin ETFs, with share prices tracking BTC performance

Examples include:

MicroStrategy (now rebranded as Strategy): Holds over 630,000 BTC

Metaplanet (Japan): Holds nearly 19,000 BTC and was recently added to the FTSE Japan Index

Twenty One Capital, Semler Scientific, and others: Emerging players with aggressive BTC accumulation3

💡 Why Are They Stacking Bitcoin?

1. Inflation Hedge

Bitcoin’s fixed supply (21 million coins) makes it attractive as a store of value—especially when fiat currencies are being devalued through monetary expansion.

2. Digital Scarcity + Liquidity

BTC offers 24/7 global liquidity and digital scarcity, making it more flexible than gold or real estate.

3. Investor Demand

Holding Bitcoin can attract retail and institutional investors seeking crypto exposure—especially in jurisdictions with limited ETF access.

4. Narrative & Branding

Being a Bitcoin-forward company can boost visibility, media coverage, and shareholder enthusiasm. It’s a way to signal innovation and conviction.

5. Capital Optimization

Some firms issue stock or bonds to buy BTC, betting that Bitcoin will outperform traditional investments over time—even if it dilutes shares3.

🧠 Strategic Insight

These companies aren’t just speculating—they’re redefining corporate finance. By turning idle cash into Bitcoin, they’re making a macro bet on digital assets as the future of money. It’s high risk, high reward—and increasingly, it’s becoming a competitive differentiator.

Bonus:

Consider this:

Global liquidity has been one of the most correlated indicators of bitcoin (and then altcoin) performance. Printing presses are firing back up worldwide and we now have the largest gap/deviation between M2 (measure of global liquidity) and the CURRENT BITCOIN PRICE. We could be in for a dramatic “catch up” if history is any guide.

Do your homework!

Chart credit to InvestAnswers podcast (below. excellent)

Good analysis of Trumps new token that just launched: WLFI

https://www.youtube.com/live/cVOkAPHytnM

Heads up!

PYTH is surging today—up over 50%—thanks to a major government endorsement. The U.S. Department of Commerce just announced it will use the Pyth Network to publish official economic data like GDP figures directly on-chain, marking a historic shift in how macro data is distributed2.

Here’s why the market’s reacting so strongly:

Institutional validation: Pyth is now officially part of the U.S. government’s blockchain infrastructure, alongside Chainlink. That’s a huge credibility boost.

Massive volume spike: Trading volume exploded over 3,200% overnight, hitting $813.8 million.

Social sentiment: Crypto Twitter lit up after Bloomberg ran the headline “US Puts GDP Data on the Blockchain in Trump Crypto Push,” fueling retail hype.

Real-time impact: The product is already live—users can access GDP data on-chain, and Pyth plans to expand into other macro indicators.

This isn’t just a pump—it’s a signal that decentralized oracles like Pyth are becoming core infrastructure for financial data