Everyone who has Ever Bought Bitcoin and Held for 4 Years+ is Profitable. PERIOD

THERE ARE NO EXCEPTIONS

Regardless of the stellar reputation of the 12 month period of the 4 year cycle which lies directly ahead of us, it's always important to keep in mind that the most tried and true strategy to success in Bitcoin is a long-term approach.

Everyone who has ever invested in Bitcoin and held for four years or more is profitable—there are no exceptions, historically, and bitcoin’s been around almost 17 years now.

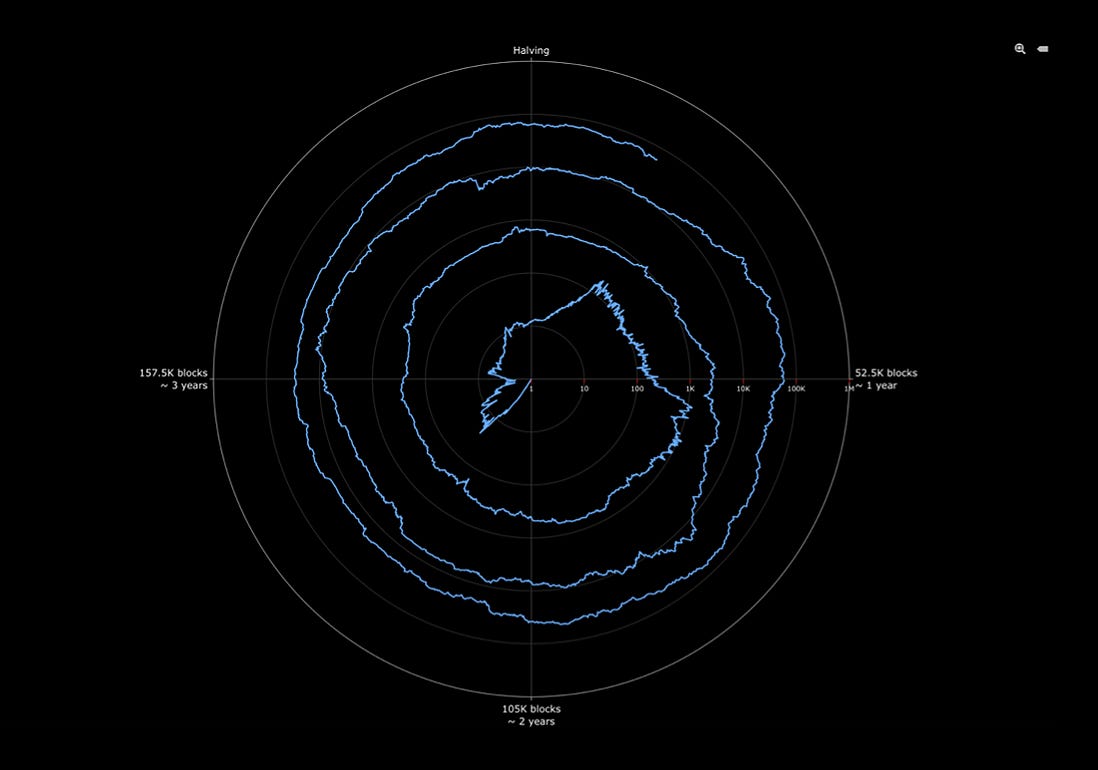

Source: Bitbo.io — Note: Chart uses a logarithmic scale for Bitcoin’s price.

If the chart above is new to you, it represents the price of Bitcoin on a four-year clock (aligned with the Halving schedule). The chart spirals with time. Because the price of Bitcoin has always moved in positive direction in any four-year period, the line has continually drifted outward. If the line were ever to move inward enough that it crossed an earlier point in the spiral, that would mean the streak of never losing in a four-year window would be over.

But, it is worth noting that even though it visually appears that spiral is tightening, the scale of the price axis is logarithmic, so in reality the strength of this trend is actually increasing.

This is the first truly new asset class since the discovery of Texas Tea (oil) in 1853.

No Kidding.

If you don’t have any exposure, you might want to ask yourself “WHY NOT?”

It’s never been easier to start adding $100 or even less!

Here are some of the bitcoin funds you can buy in your IRA or brokerage account:

(*not financial advice. Every potential investment involves risk of one kind or another. Always do your own research or consult your advisor)

Bonus:

Listen to what Wall Street veteran Bob Burnett said in a a recent newsletter to investment professionals (excerpted)

How Corporate Treasuries and Tether are driving insatiable Bitcoin demand:

“Tether is a digital asset that is commonly called a stablecoin and it primarily trades under the symbol USDT. Its purpose is to create what is essentially a digital version of the U.S. dollar that can be accessed and used anywhere in the world. Its value is pegged hard to the U.S. dollar because it is more than fully reserved (more on this shortly). It's not an asset in which people invest to earn returns, but one in which they move wealth to hold value for a short period before making an international purchase, or for people that live in markets where the local currency and/or banking are unstable or unusable. These goals overlap with those of Bitcoin, but Tether lacks the ability to appreciate, and in fact, much like holding U.S. dollars in their native form, they actually lose value with time because they are directly impacted by inflation.

In many ways, Tether has become a method to use the U.S. dollar without acquiring the U.S. dollar, or any part of the global banking system. Tether has become widely accepted as a form of payment, especially in the Global South, and now has a market cap of $114B. This means it has risen to the position as the cryptocurrency with the third largest market cap, and it would not surprise me if it rivaled Ethereum within the next three to five years for the number two position.

Tether’s tremendously popularity and rapid growth makes it a short-term threat to any corporation providing international banking services, and in practice, it could rapidly dollarize some smaller nations and displace/devalue their native currencies.

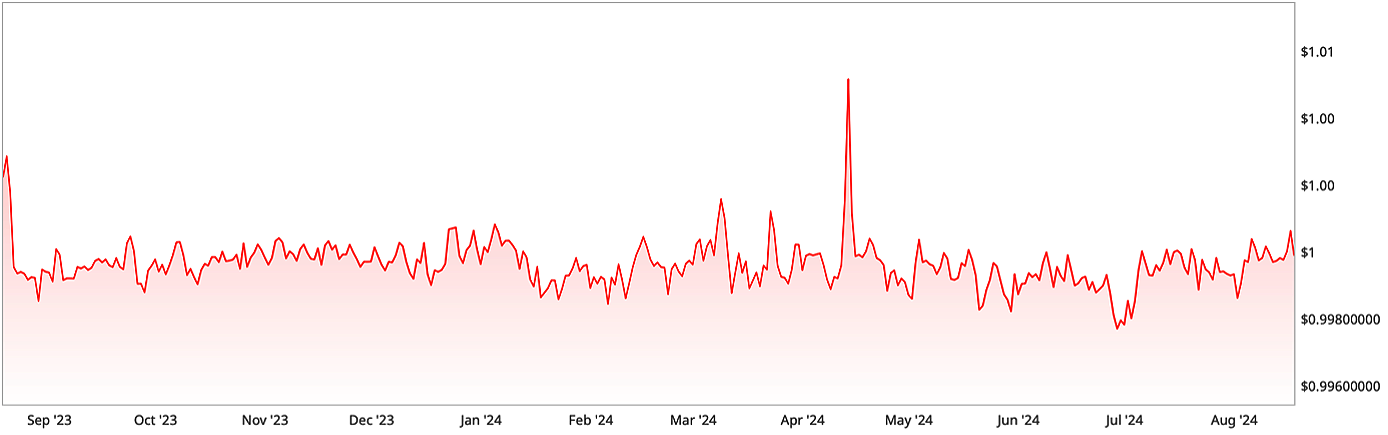

As mentioned earlier, Tether is a fully reserved stablecoin and as a result, USDT, Tether’s native currency, trades in an extremely narrow band around one U.S. dollar.

Tether (USDT) Price Chart, August 2023 To August 2024

Source: Coindesk.com

Tether’s stability can be tied first and foremost to its strategy of buying 90-day U.S. Treasuries as the backing instrument for the vast majority of its reserve. This keeps them in an extremely liquid position should there be a large number of redemptions. As Tether has ascended to the top ranks in the cryptocurrency world, they have also become one of the largest holders of T-bills. They now hold over $90B of U.S. debt and it puts them essentially on par with Mexico and Germany. Truly amazing that their holdings now put them in a class with first-world nations.

In a recent interview with Preston Pysh on The Investors Podcast, Tether CEO, Paulo Ardoino talked in some detail about their strategy. I believe there were two key takeaways.

1. Tether has no interest in any U.S. Treasury product with longer than a 90-day maturity. This is to ensure that Tether never has any issues should it be subject to the equivalent of a bank run. Even a reversal of the inverted yield curve would not sway them from this strategy.

2. Regardless of the yield, upon maturity Tether takes the vast majority of the yield from T-bills and invests it—primarily in Bitcoin. It reinvests the basis in new T-bills.

This allows Tether to always maintain the proper base reserves in a highly liquid and stable asset but over time they slowly accumulate another set of assets with high growth potential.

This leads to the main reason I wished to discuss Tether in this newsletter. Tether has used this strategy to accumulate over 80,000 Bitcoin. It is reminiscent of the corporate treasury management strategy implemented by Michael Saylor at Microstrategy (MSTR) to build holdings of 226,500 as of August 1, 2024. This means over 1.5% of the entire Bitcoin supply is now held by just these two organizations and both have committed to acquiring more and essentially never selling.

It is my opinion that corporations building material Bitcoin positions is just in its infancy and it is one of the most likely catalysts to rapid Bitcoin adoption and price growth.

Consider how you can best get positioned now for an amazing 2025!

PS: If this info adds value to your life, consider becoming a paid sub! You’ll be surprised how affordable it is, and what we do with your money!

BE VERY CAREFUL WITH SCAMMERS, ESPECIALLY WITH BITCOIN.

WOULD YIU HAVE BEEN TAKEN IN BY THIS GUY. BET SO

ANOTHER REASON THE CRYPTO ETFS ARE AN ATTRACTIVE RISK DIVERSIFIER.

https://youtu.be/BDK8BRf252k?si=EIZOIzXQ9dXJQskw

Bitcoin Based Life Insurance is a Reality:

(*INFO ONLY. NOT ADVICE. DYOR*)

Life insurance, huh? Boringggg.

We get it—but hear us out for a sec.

This one’s different: it lets you benefit while you’re still alive.

Here’s how: You can use the policy’s value to take out a tax-free loan.

Sounds confusing? Let’s break it down:

Pay $BTC into the policy today at $100K

In year 2035, $BTC is at $1M

Borrow against the policy and sell that $BTC for $1M cash.

The best part? No capital gains tax on the $900K appreciation.

Pretty neat, huh?

Click the link below to learn more

https://milkroad.com/sponsored/meanwhile-life-insurance/?