OFF TO A GREAT START:

The last 12 Hours since Bitcoins once every four years event have been mind-numbing.

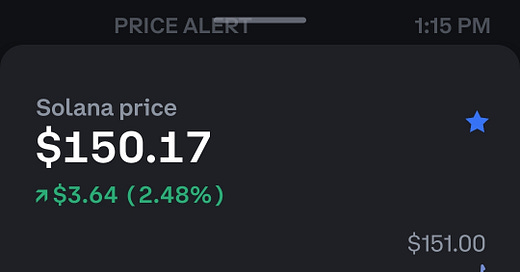

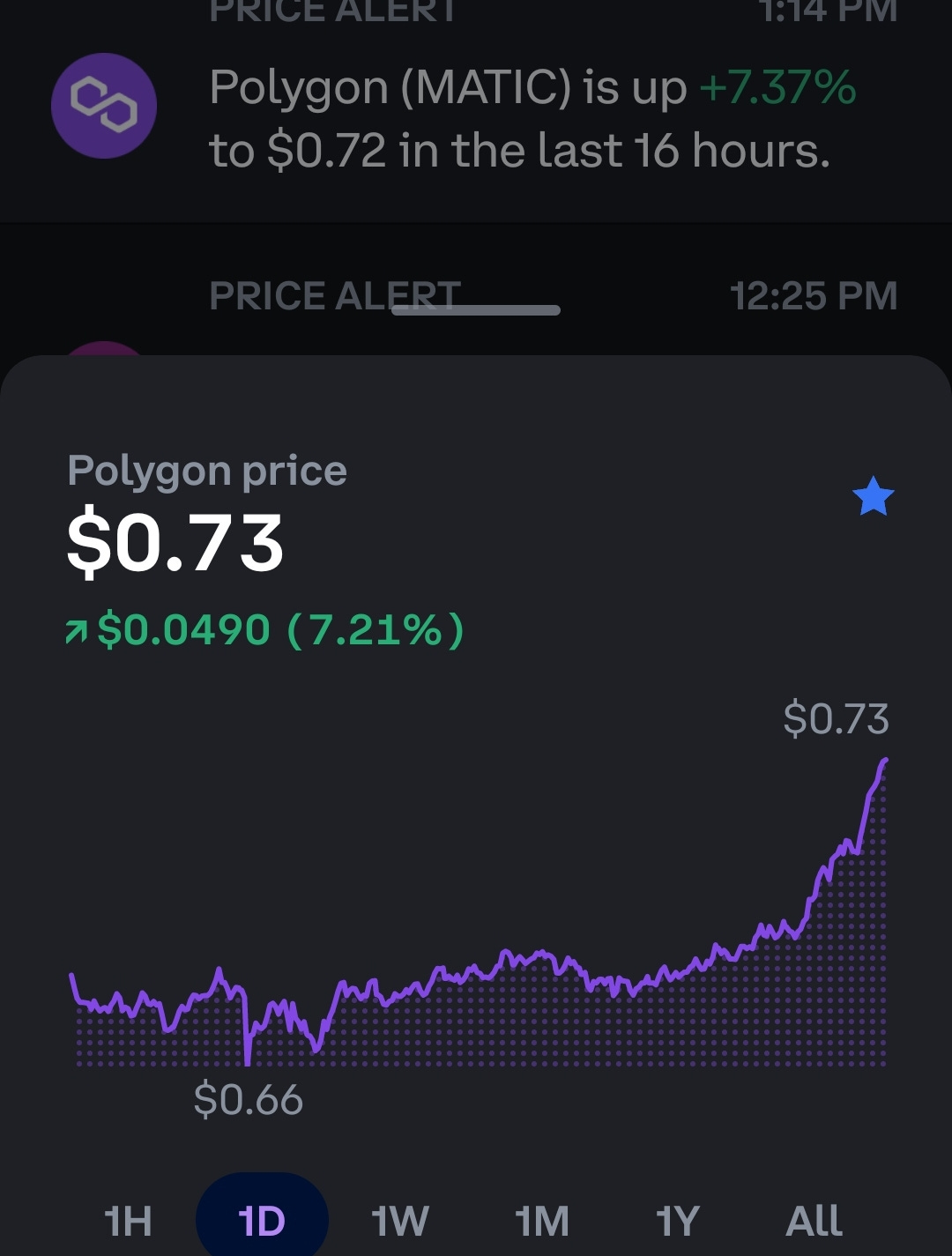

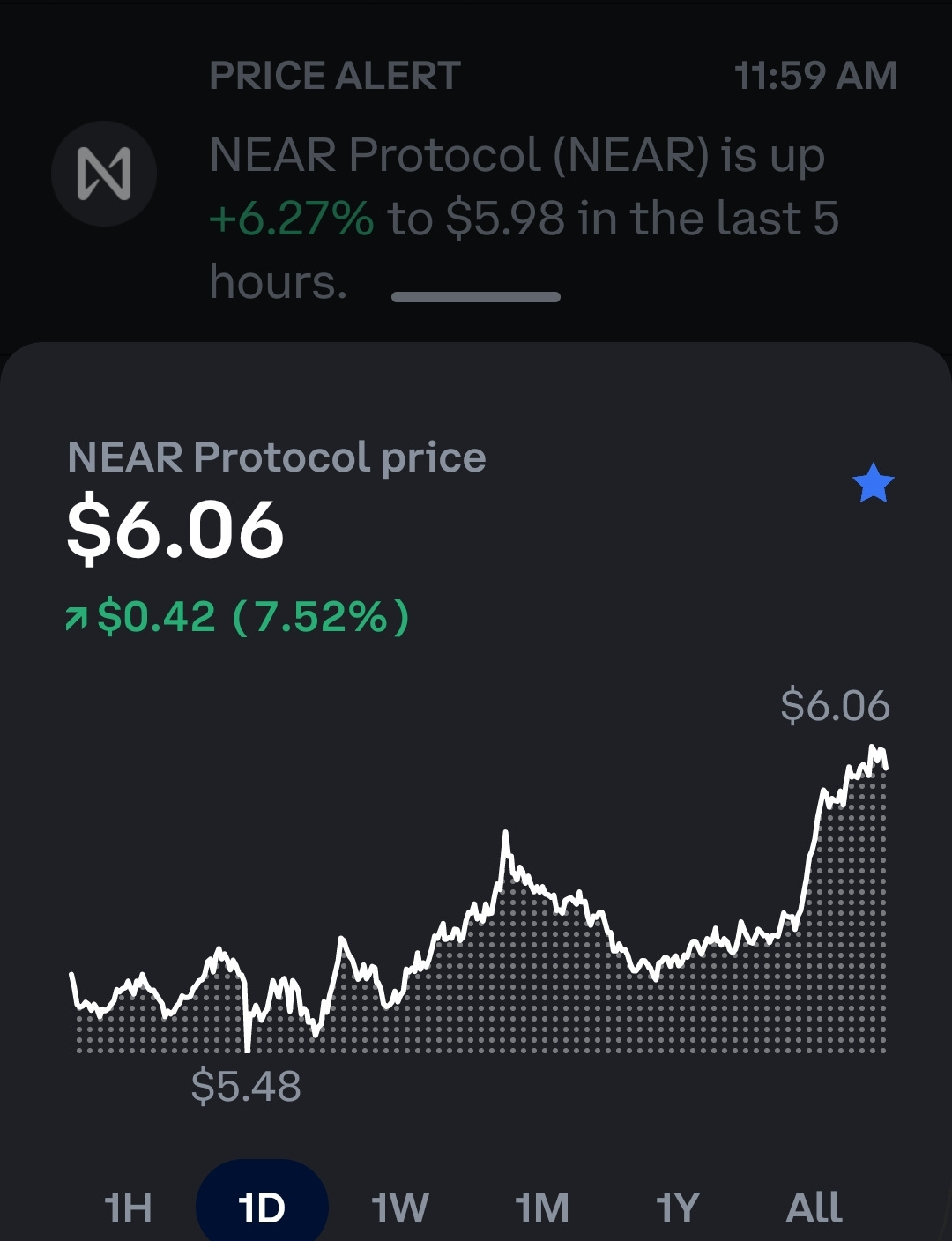

Alto-coin season has started early, with unbelievable gains in micro-coins and healthy uptrends in the core coins.

“Weyah just gett’n Staahted!”

-Changa

(*actual real life examples from the last 12 hours, but NOT current recommendations. Nothing here is advice of any sort):

If you're just getting your feet wet, I suggest you read our recent STNN post on Alto crypto IRA for solid basics. If you have $50 you can get started, and they will match you with another $50 account credit that's yours to invest and keep (**Important -you must use special link in post below)

ALTO: BITCOIN & ALL THE CRYPTOS ON COINBASE, BUT TAX FREE. You KNOW you need a smidge of Crypto, but HOW?

First, Nothing here is advice, yada.. (it never is. You are always in charge of your life, information deficiencies, and action/failure to act. Thankyou. *changa may now proceed -ed Smurfing the New Normal is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscri…

SATURDAY AFTERNOON UPDATE!

HERE ARE A FEW HIGHLIGHTS SINCE THE HALVING YESTERDAY;

Are you ONBOARD?

If you have some experience and are looking for ideas after having stacked your core holding of Bitcoin, Solana and Ethereum (not advice) then you'll find value listening closely to this:

Bottom line.

If you put the effort in and BELIEVE in yourself, use common sense and position sizing, the time you put into study this dynamic emerging space can be potentially life changing.

If this first post-halvening day is any indication, we may have to schedule our NEXT STNN stack family cruise earlier than planned!

ENJOY!

First STNN Cruise!!!

In Celebration of the proverbial “embarrassment of riches” our Smurfing the New Normal Fam has made together over the last 15 months since Changa's January 2023 call on bitcoin, we are CELEBRATING AT SEA!Smurfing the New Normal is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Good work calling those funds. I’ve been invested in actively managed funds for years now. My faith is in the fund manager who consistently plays the market well. I just direct the investments towards asset classes that feel right and are consistent with my risk profile. But after a recent transition to a less adventurous portfolio (safer de-risked plays) I couldn’t resist the frisson of a dabble in crypto on the wild side!

For those who don’t have an appetite for direct investment in cryptocurrency there’s a more comfortable alternative route. This isn’t financial advice either, free advice is generally worth what you paid for it in any case.

I just bought (before the halvening) stock in three block mining companies with strong fundamentals. The relevant ones being financial resilience to continue operating and investing in data processing performance after the revenue cut and strong computational infrastructure (current and in the pipeline).

Miners are rewarded in BTC so you’re exposed to the same risk and volatility as a direct investor in crypto but you’re not messing with digital wallets and dodgy traders. NASDAQ is a far more regulated place for the more risk averse.