With the Fed cutting rates and China blasting stimulus, investors are looking to hedge currency risk. Should they buy bitcoin or gold? The short answer is: What do you want: more return or less risk?

(*NOTHING HERE IS INVESTMENT ADVICE. DO YOUR OWN DUE DILLIGENCE*)

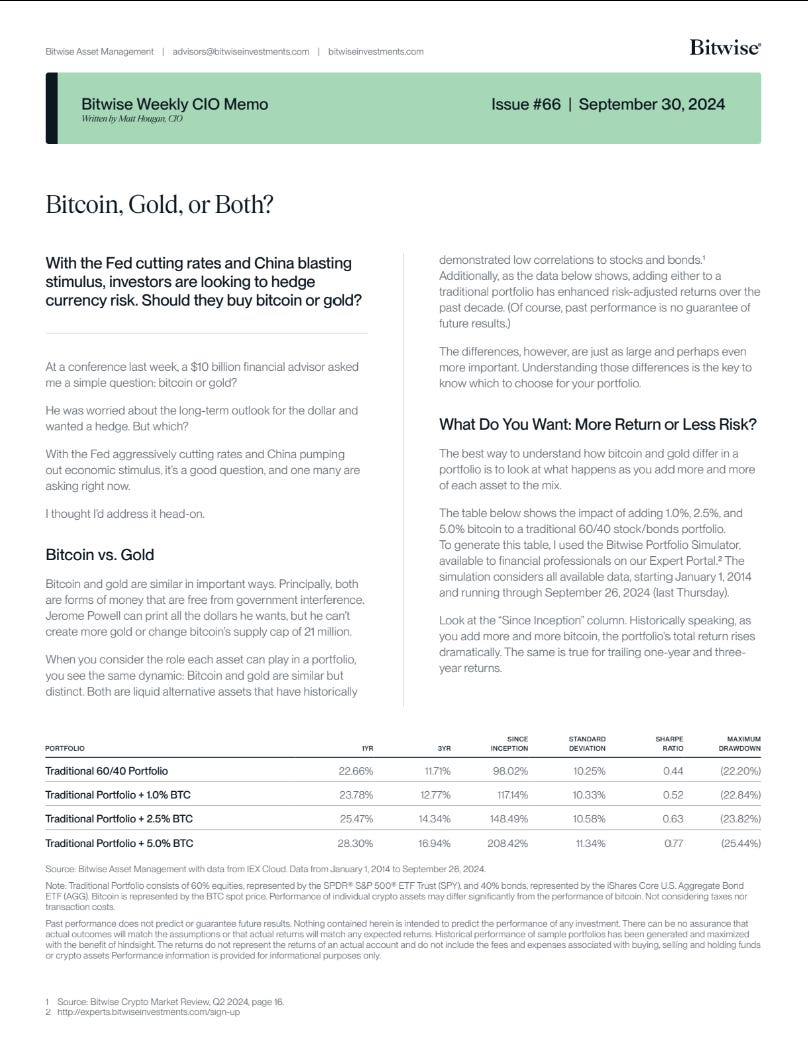

According to the simulation in the memo, a 2.5% allocation to bitcoin would have boosted the portfolio’s return 50 percentage points, from 98% to 148%, while the standard deviation would have risen just 33 bps.

Contrast that with what happens when you replace bitcoin with gold.¹

As the table shows, there is almost no effect on return: Over the full 10+ years of the study, a 2.5% allocation to gold would have boosted the portfolio returns by just 1%! Where gold does have an impact, however, is on the volatility side (see the Standard Deviation column again), which falls as you add more and more gold to the mix.

MONSTER November setup for Bitcoin as we broke through 72k resistance today!!!

(This is the best crypto show on YT btw IMHO)

Enjoy

https://www.youtube.com/live/O-TjHII3myg?si=BUCHbHI1onfF9AE-

JUST IN: $725 billion Bernstein predicts #Bitcoin will hit $200,000 in 2025, calling the forecast “conservative.”