BITCOIN

NO OPTIMISM REQUIRED

This means that how far price is stretched explains more of what happens next than rates, CPI, narratives, or sentiment

note: *nothing here is financial advice. Always do your own research

The One Number That Explains Bitcoin’s Price

The number is −0.65.

That’s Bitcoin’s Z-score.

If you’re not a statistician, here’s all that means:

a Z-score tells you how far price is stretched from what’s normal.

• Z = 0 → price is normal

• Z > 0 → price is stretched high

• Z < 0 → price is stretched low

It doesn’t predict hype.

It measures tension.

Here’s why −0.65 matters.

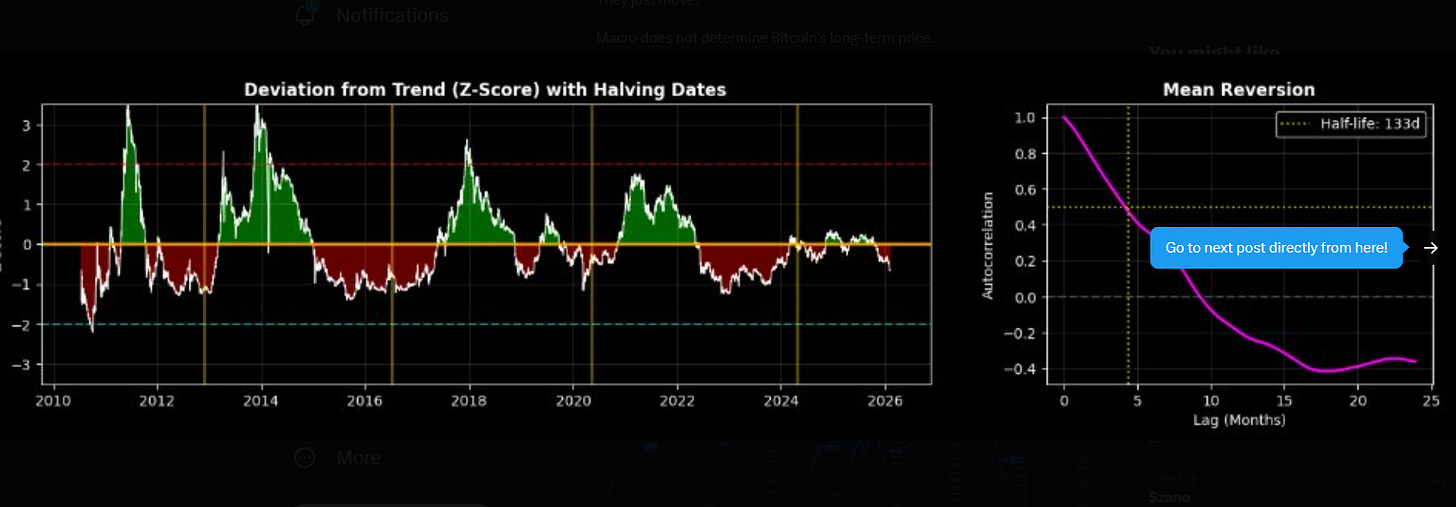

At this point after every prior halving, Bitcoin was above trend:

2012: +1.02

2016: +1.32

2020: +0.48

Today: −0.65

That has never happened before.

Not once in 15 years.

What the numbers say next

I ran the full dataset: 5,681 daily observations.

Every crash. Every bubble. Every macro regime.

The relationship between Z-score and future price is not weak.

Correlation to forward 18-month returns: −0.745

Variance explained by this single variable: ~56%

That means how far price is stretched explains more of what happens next than rates, CPI, narratives, or sentiment.

From Z ≤ −0.6 (where we are now):

• 12-month win rate: 100%

• Negative outcomes: 0

• Worst case: +47%

• Median outcome: +181%

From Z ≥ +1.0:

• Win rate: 44%

• Worst drawdown: −73%

That’s not opinion.

That’s asymmetry.

So why doesn’t price “feel” bullish?

Because Bitcoin is no longer being priced like a trade.

It’s being used.

Bitcoin now trades 24/7, settles instantly, and can be pledged as collateral. Capital can move through it without anyone smashing the buy button on an exchange.

That suppresses price temporarily.

It does not weaken demand.

The market calls that “no interest.”

The math calls it misclassification.

Meanwhile, supply math tightened permanently.

Issuance was cut in half in 2024.

ETFs absorb hundreds of BTC per day off-exchange.

Institutions accumulate quietly.

Selling exists but it’s being transferred from short-term holders to long-term balance sheets at roughly a 36% discount to network value.

That’s not distribution.

That’s inventory changing hands.

Mean reversion doesn’t need a catalyst.

Deviation half-life: ~133 days.

That means:

• ~50% of the gap closes in ~4 months

• ~75% in ~8 months

• ~90% in ~12 months

No optimism required.

No narrative required.

Time does the work.

This isn’t a trade.

It’s a position.

The bet isn’t that “Bitcoin moons.”

The bet is that math didn’t stop working this cycle.

Because when highly stretched systems snap back, they don’t negotiate.

They just move.

Macro does not determine Bitcoin’s long-term price.

Distance from equilibrium does.

more:

credit to

We'll go to 85k then it will crater. Might even touch 50k, but then will be the rip higher that no-one can stop. There is much too much sell pressure from an enormous number of people trapped underwater at even 85k where as soon as they reach that number they will sell break even or cut their losses.